Bitcoin (BTC) Reaches Extreme Greed Zone – Triggers $150M Short Squeeze

The crypto market has hit the highest fear and greed index score of 76 since 2021. Meanwhile, in the last 24 hours, nearly $150 million worth of short positions have been liquidated.

Decisions on the spot Bitcoin exchange-traded funds (ETFs) applications could be announced this week. The market participants majorly expect approval from the Securities and Exchange Commission (SEC). Hence, Bitcoin and the broader crypto market have been rallying since late 2023.

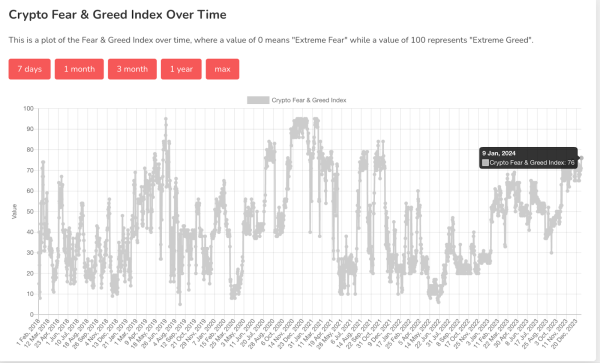

Bitcoin Greed Revisits 2021 Levels

The screenshot below shows that on January 9, 2024, the Bitcoin Fear and Greed Index stands at a score of 76, which indicates extreme greed. The index has visited the “extreme greed” level for the first time since 2021, when Bitcoin was at its all-time high.

The index score includes factors such as volatility, market momentum (volume), social media sentiment, dominance, and trends.

Bitcoin Fear & Greed Index. Source: Alternative.me

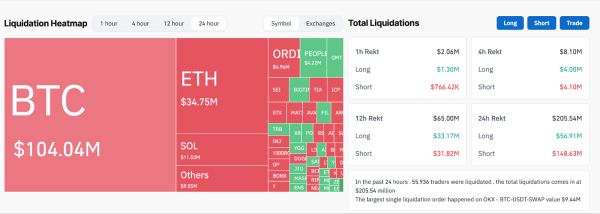

Bitcoin visited the extreme greed zone, hitting the $47,000 level on Monday. The rally of over 9% caused total short liquidations worth nearly $150 million in the past 24 hours.

Moreover, even long positions worth $56 million were liquidated.

Crypto Liquidations. Source: Coinglass

Primarily, due to the ETF decision, the market might be subject to extreme volatility in either direction. For instance, on January 3, a whopping $500 million worth of trades faced liquidations in less than one hour.

The crypto exchange Bitfinex shared its Alpha report with BeInCrypto, warning the readers about the possibility of pullbacks.

“We expect the market in the early months of this year to be vulnerable to pullbacks, with increased risk to leveraged longs,” Bitfinex said.