Bitcoin Futures Smart Money Index Hits All-Time High Ahead of ETF Decision

The amount of institutional capital bullish on BTC has hit a new all-time high as the deadline for spot Bitcoin ETF decision approaches.

The price of Bitcoin may be trading 38% below its $69,000 all-time high of November 2021. However, a metric that measures the amount of institutional capital bullish on the leading cryptocurrency has hit a new all-time high.

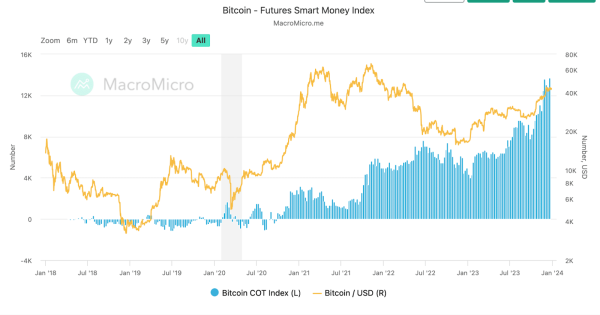

The Bitcoin Futures Smart Money Index by MicroMacro calculates the ratio of institutional capital that is long or short Bitcoin using the popular trading venue CME.

CME is an ideal exchange for gauging such interest as a vast percentage of institutional BTC trading notably takes place on the CME. Recall that the exchange recently overtook Binance as the leading destination for futures contract trading.

The Smart Money Index compares Bitcoin longs and shorts on CME with a view to determine whether investors are bullish or bearish on the asset.

In calculating the amount institutions have invested, the index taps into the weekly Commitment of Traders Report published by the United States Commodity Futures Trading Commission (CFTC).

In the past week, the index hit a new all-time high of 13,711, surpassing the record of 13,609 set only three weeks earlier. Notably, the index has seen an over 300% surge since the turn of the year, having posted a 4,351 figure on the opening week of the year.

Bitcoin Futures Smart Money Index

Institutional Interest in BTC at Its Peak

The record-breaking figure for the Smart Money Index underlines increased institutional interest in Bitcoin, ahead of what many believe will be a watershed moment for the digital asset.

For one thing, the advent of a spot Bitcoin ETF in the United States is largely expected to pave the way for more institutional capital to flow into the cryptocurrency.

Additionally, it would further legitimize BTC as a reliable asset class. Major traditional investment firms such as BlackRock, Fidelity Investments, and Templeton are all in the race to launch a spot Bitcoin ETF alongside several other competitors.

The United States Securities and Exchange Commission (SEC) is expected to announce its decision on pending Bitcoin ETF applications ahead of a scheduled January 10 deadline. Friday, December 29, has been slated as the final deadline for applicants to adjust filings ahead of a potential approval.

Meanwhile, Bitcoin remains under watch, with its price still significantly lower than its all-time high. The leading cryptocurrency has struggled to stay above $43,000 in the past week. Yet, it looks set to close the year with an over 150% increase on the yearly chart, having regained the huge losses posted in 2022.