Bitcoin Price: Technical Analysis and Future Movements

Today (September 8th), Bitcoin experienced a 1.64% drop, falling to around $25,843, wiping out almost all of its recent gains. Bitcoin’s price has been observed to be indecisive as we enter September. This indecision is shaped by uncertainties such as the ongoing delay in the spot Bitcoin ETF and the Federal Reserve’s interest rate decision. The increase in Bitcoin reserves on exchanges and the closing of long positions in the futures market are among the factors behind the price drop and affecting market volatility.

Technical Correction in Bitcoin

The price of BTC struggled to find direction in September, fluctuating between small gains and losses amidst decreasing liquidity supply. The main reason for investor uncertainty is the ongoing delay in the spot Bitcoin ETF and the uncertainty surrounding the Federal Reserve’s interest rate decision this month, as warned by ARK Invest.

Therefore, the price of Bitcoin is trading within a narrow range defined as $26,450 resistance and $25,550 support (red area in the graph below). This situation likely led investors to buy from support and sell from resistance. The same strategy likely fueled the sales on September 8th, as there was no buying momentum near the $26,450 resistance, prompting a retreat in the BTC/USD pair.

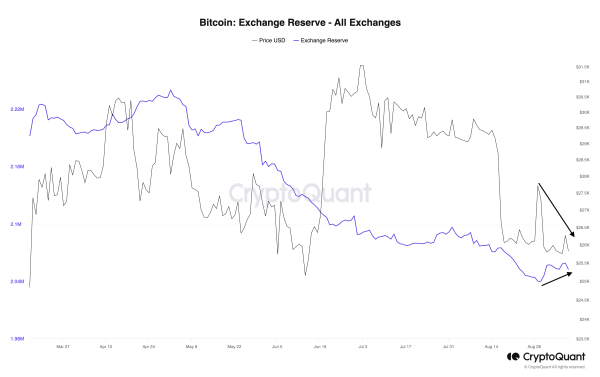

Increase in Bitcoin Reserves on Exchanges

A small increase in BTC balances on exchanges may have also played a role in the price drop. Specifically, Bitcoin reserves have increased from 2.03 million to 2.05 million BTC so far in September. Simply put, the more BTC there is on exchanges, the greater the potential pressure on the market.

Bitcoin sales triggered a wave of long liquidation in the futures market. In particular, the drop in spot BTC price led to a $7.78 million long liquidation until September 8th. In other words, traders were forced to reclaim the amount they borrowed against Bitcoin collateral, intensifying selling pressure in the market.

Where Will BTC Price Go Next?

Technically, the September 8th sell-off pushed the Bitcoin price below the 4-hour chart’s EMA 50 (exponential moving average; red wave in the graph below). This move increases the likelihood of BTC continuing its downward trend towards $25,550 in the coming days. This level corresponds to a support combination consisting of a horizontal level (bottom of the red bar) and a decreasing trend line (black).