ChatGPT makes bold price prediction for Bitcoin in 2024

Bitcoin (BTC) trades at $39,800 on January 25, 14 days after reaching a local top at $48,900 following the much-awaited Bitcoin spot ETF approval. Meanwhile, investors look forward to the block subsidy halving, which is expected in April 2024.

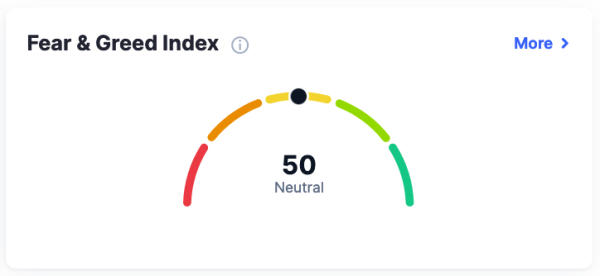

Notably, the overall sentiment in the cryptocurrency market is neutral, according to the Fear & Greed Index by CoinMarketCap.

Given the uncertain moment for crypto investors, Finbold turned to ChatGPT-4 artificial intelligence (AI) for insights on the leading project.

For that, we asked a GPT-4 Turbo API for a bullish and bearish bold prediction for Bitcoin in 2024. Curiously, the platform used for this request was NanoGPT, which works in a pay-per-prompt model with payments in crypto.

ChatGPT-4 bold predictions for Bitcoin in 2024

Looking at the best-case scenario, ChatGPT sees Bitcoin trading within the range of $100,000 to $200,000 in 2024. In the meantime, the AI sees a BTC price drop between $10,000 and $15,000 in the worst-case scenario.

Bitcoin’s bold bullish prediction for 2024 by GPT-4

- “In the best possible scenario, the Bitcoin halving in 2024 reduces the supply of new bitcoins entering the market, which historically has led to an increase in price as demand outstrips supply.

- Increased adoption by both retail and institutional investors continues, bolstered by more accessible and secure platforms, as well as growing recognition of Bitcoin as a digital store of value akin to “digital gold.”

- Technological advancements in the broader blockchain space, including scalability solutions like the Lightning Network, may improve Bitcoin’s utility and transaction efficiency, leading to broader use in everyday transactions.

- Continued inflation or economic instability in traditional financial systems could lead to more investors looking to Bitcoin as a hedge against fiat currency devaluation.

- If all these factors align positively, along with sustained investor interest and minimal negative regulatory impacts, we could see Bitcoin surge upward. A bold, yet possible, bullish prediction for the end of 2024 might be within the range of $100,000 to $200,000.”

– ChatGPT

Bold bearish prediction for BTC by ChatGPT

- “In the worst possible scenario, the reward halving could have a less than expected positive impact if miners find it unprofitable to continue their operations, leading to fears about the security and integrity of the network.

- Negative regulatory developments, such as stringent regulations or outright bans in major markets, could hurt investor sentiment and limit adoption.

- A significant technological flaw or successful large-scale attack on the Bitcoin network might undermine trust in the cryptocurrency.

- Rising competition from alternative cryptocurrencies or government-backed digital currencies could divert interest and investment away from Bitcoin.

- If these factors play out in a particularly negative way, combined with a potential market over-saturation or general loss of investor confidence, a bold bearish prediction could potentially see Bitcoin prices drop to $10,000 to $15,000 by the end of 2024.”

– ChatGPT

Conclusion

In conclusion, ChatGPT predicts Bitcoin will trade between $10,000 and $200,000 in a bold outlook for both bulls and bears. This large range evidences how unpredictable and volatile trading cryptocurrencies can be, including the effectively largest and most solid project so far.

All in all, price performance depends on supply and demand, which are influenced by multiple factors. Investors must remain cautious and conduct their own thoughtful analysis before being exposed to financial assets.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.