Did Bitcoin Hit a Market Top? Smart Whale Sold 2,742 BTC

A smart Bitcoin whale booked significant profits, raising questions about the current state of the cryptocurrency market. This move also aligns with an on-chain metric, which gave a strong indication of changing sentiments.

Analysts believe whales could be moving into a risk-off environment, foreseeing a de-leveraging phase.

Is Bitcoin About to Reach a Market Top?

The Inter-Exchange Flow Pulse (IFP), a tool developed by CryptoQuant, tracks the flow of Bitcoin between spot and derivative exchanges. It serves as a barometer for market sentiment. Technically, increasing Bitcoin flow to derivative exchanges signals bull runs, and decreasing flows indicate bearish trends.

Recently, the IFP trend has taken a noteworthy turn, dipping below its 90-day average. Historically, such shifts have been precursors to bear markets, suggesting a potential downturn in Bitcoin’s price.

Bitcoin Inter-Exchange Flow Pulse. Source: CryptoQuant

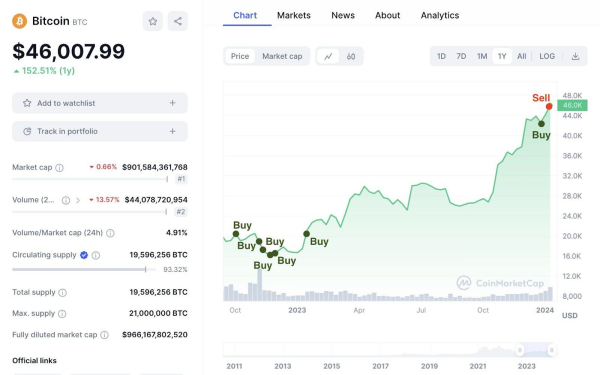

Amidst these market fluctuations, a strategic transaction by a notable Bitcoin whale has become the focal point. This whale secured a substantial profit of over $75 million, a 41.5% increase, by selling 2,742 BTC, valued at approximately $127.7 million.

The timing of this sale, which occurred shortly after the launch of spot Bitcoin ETFs, is particularly significant. Indeed, some experts believe that while spot Bitcoin ETFs are bullish from a long-term perspective, it might be a “sell the news event” for the short term.

“The approval [of spot Bitcoin ETFs] should be very bullish mid- and long-term, but for the short-term it remains to be seen. The market had (almost) fully priced in the approval (which is being partially confirmed by the lack of a super rally), and it remains to be seen if we get the typical “buy the rumor – sell the news” type of action in the short-term,” Jaime Baeza, founder of AnB Investments said.

Crypto Whale’s Bitcoin Trading History. Source: SpotOnChain

Still, the whale transaction is not just a standalone event but part of a broader trend observed by CryptoQuant CEO Ki Young Ju.

According to Ju, Bitcoin whales are increasingly adopting a risk-off mode, steering clear of derivative exchanges. Consequently, this behavior clearly indicates a de-leveraging phase within the cryptocurrency market.

“Bitcoin whales are shifting to risk-off mode, avoiding sending BTC to derivative exchanges. Red up. De-leveraging time,” Ju said.

The shift in whale behavior and the IFP’s recent dip have important implications for investors. It signals a time of increased vigilance and a re-evaluation of investment strategies in the face of a potential Bitcoin market top.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.