$4,500,000,000,000 Asset Manager Says Ethereum (ETH) Is Currently Undervalued – Here’s Why

The crypto-focused subsidiary of investing giant Fidelity Investments says Ethereum (ETH) is currently trading at a discount.

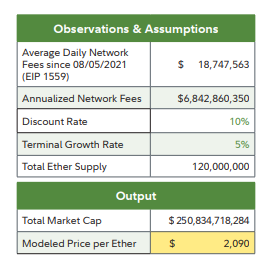

In a new report titled ‘Ethereum Investment Thesis’, Fidelity Digital Assets says that at the current Ethereum supply of around 120 million and annualized network fees of over $6.8 billion, the modeled price of ETH when a discounted cash flow model is applied is around $2,090 – around 28% above the current price.

Source: Fidelity Digital Assets

The asset manager says that Ethereum’s value is correlated to network activity and by extension the fees generated, a figure that Fidelity expects to grow by double digits over the next seven years and hit over $20 billion in 2030.

“The value assigned to ether is more easily modeled following the network’s shift to proof-of-stake. Demand for block space can be measured via transaction fees. These fees are both burned or passed on to validators, thereby accruing value for ether holders.

As a result, fees and ether value accrual should be inherently related over the long term. An increased number of Ethereum use cases creates greater demand for block space, which leads to higher fees and greater value and utility in the form of yield rewarded to validators.”

Source: Fidelity Digital Assets

On the risks that could hamper the fees generated on the Ethereum network, Fidelity Digital Assets says,

“The relationship between ether and the value it provides to network users may weaken if scaling technology erodes fee revenue unless volumes increase and offset this margin compression.”

Ethereum is trading at $1,630 at time of writing.

Generated Image: Midjourney