ETH Price $1,630 Support On The Line, Time To Buy Or Sell Ether?

ETH price is searching for support to relieve bulls of the pressure that has continued to beat them since mid-May. Although the smart contracts token has over the last few months attempted to sustain the price above $2,000, losses upon losses have left investors feeling the pinch.

ETH Price Dealing With A Weak Market Structure

The prevailing technical and macro environments foreshadow further losses before bulls arrest the dilapidated market structure to push for a significant trend reversal.

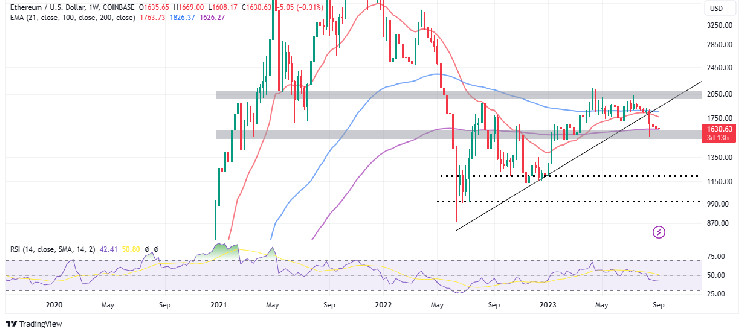

Investors should pay attention to the 200-weekly Exponential Moving Average (EMA), which currently upholds the bulls’ grip on the support at $1,630. Otherwise, Ethereum live price risks sliding below this support and testing the subsequent major buyer congestion at $1,350.

ETH/USD weekly chart | Tradingview

The Relative Strength Index (RSI) shows that bears are firmly in control and that it may take a miracle to reverse the trend.

Meanwhile, investors would be in luck if the Securities and Exchange Commission (SEC) green-lights the first futures-based Ethereum exchange-traded fund (ETF) this September, or in October.

If history repeats itself, ETH price might be up for a 60% rebound following the approval. Bitcoin rallied by the same margin two and a half years ago when the agencies greenlighted the BTC futures ETF.

Meanwhile, Cathie Wood’s Ark Invest has filed a proposal with the SEC seeking to offer the first spot ETH ETF product. The product, referred to as ARK 21Shares Ethereum ETF is similar to the spot BTC ETFs that the agency delayed last week.

The SEC said that it needed time to digest the proposals following Grayscale’s win in the appeals court. Grayscale Investments, the largest digital asset manager in the world is seeking approval to convert its Bitcoin Trust (GBTC) shares into a spot Bitcoin ETF.

Coinbase was named the custodian in the filing, which means the exchange will store the Ethereum backing the product likely to be listed on Cboe BZX Exchange.

Experts believe the agency will approve the futures-based ETH ETFs, considering BTC futures ETFs have been operational since 2021. Eric Balchunas, a senior ETF analyst believes more spot ETH ETF proposals will follow in the footsteps of Ark Invest, increasing the chances of approval.

BOOM: ARK just filed for a Spot Ether ETF, the first one.. prob more coming imminent pic.twitter.com/PjK5aSNPlS

— Eric Balchunas (@EricBalchunas) September 6, 2023

The area between $1,530 and $1,630 represents a major buyer congestion zone. Therefore, holding within this region should not be a cause for worry, especially for medium to long-term Ethereum holders.

Related Articles

- Bitcoin (BTC) Sideways After Spot ETF Approval Delay; Altcoins To Watch

- Breaking: IMF And FSB Releases G20 Summit Paper On Crypto Asset Regulation

- Rug Pull Alert: Crypto Hacks That Shook The Web3 Industry This Week